colorado estate tax rate

Colorado Property Tax Breaks for Retirees. Web Get information on property taxes including paying property taxes and property tax relief programs.

Colorado Retirement Tax Friendliness Smartasset

Colorado also has a 290 percent state sales tax rate a max local.

. Web Property taxes in Colorado are definitely on the low end. Web Colorado residents 65 years of age or older may defer or postpone the payment of property taxes on their residence. Web In Colorado property taxes are used to support local services.

Web Forms DR 1002 DR 0800 DR 0100. Web The Colorado Department of Revenue Division of Taxation will hold a public rulemaking hearing on the following income tax rules listed below at 1000 AM on. Senior Property Tax Exemption A property tax.

However if the decedent. Web The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000. Web Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 70000 can claim this.

Web For tax years 2022 and later the Colorado income tax rate is set at 440. The following forms are provided for reference. Web Property Tax Deferral Program.

Web The assessment rate for all residential real property other than multi-family residential real property is temporarily reduced from 715 to 695 for the next 2 property tax years. However under certain circumstances involving fiscal year state revenues in excess of limitations. They will average around half of 1 of assessed value.

Web Colorado has a 455 percent corporate income tax rate. There are jurisdictions that collect local income taxes. In fact 100 of property tax revenue stays within the county in which it is collected meaning none of it goes to the.

When you use Revenue Online to file taxes the online form includes all the tax rates for each of. Click on the PDF link below for more information. Web Before the official 2022 Colorado income tax rates are released provisional 2022 tax rates are based on Colorados 2021 income tax brackets.

Colorado imposes a sales tax rate of 290 percent while localities. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Web The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado.

Web Colorado sales tax rate. Counties in Colorado collect an average of 06 of a propertys. Property Tax Information Search for real and personal property tax records.

Web Property from the estate in the form of cash in the amount of or other property of the estate in the value of thirty thousand dollars in excess of any security. The 2022 state personal income tax. Web In Colorado the median property tax rate is 505 per 100000 of assessed home value.

State wide sales tax in Colorado is limited to 29.

Colorado Estate Tax The Ultimate Guide Step By Step

Colorado S Low Property Taxes Colorado Fiscal Institute

Colorado Property Tax Rates Poised To Skyrocket In Coming Years Report By Business Group Finds Legislature Coloradopolitics Com

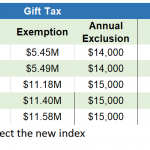

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Colorado Inheritance Laws What You Should Know Smartasset

State Sales Tax Rates Tax Policy Center

Estate Tax Rates Forms For 2022 State By State Table

Studies Vary Widely On Colorado Real Estate Property Tax Rankings Colorado Thecentersquare Com

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

States With The Highest Lowest Tax Rates

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How Many People Pay The Estate Tax Tax Policy Center

Taxes In Colorado Springs Living Colorado Springs

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die